T-47.1 RESIDENTIAL REAL PROPERTY

DECLARATION IN LIEU OF AFFIDAVIT:

WHAT BUYERS SHOULD KNOW

When purchasing a home in Texas, you may be asked to complete a T-47.1 residential real property declaration in lieu of affidavit. This document is an essential part of the real estate process and can impact your transaction. Here, we’ll cover everything you need to know about the Texas T-47.1 residential real property declaration in lieu of affidavit, including its purpose and importance.

Guide to the T-47.1 residential real property declaration in lieu of affidavit

As experienced Texas real estate professionals, we know how critical it is to have every required document completed accurately and submitted on time. One key document in many Texas real estate transactions is the T-47.1 residential real property declaration in lieu of affidavit. In this detailed guide, we’ll walk you through everything you need to know about the T-47—what date should be entered on the form, why the document matters, and how to complete it properly to help ensure a smooth transaction.

What This Guide Covers:

- What is a T-47.1 residential real property declaration in lieu of affidavit?

- Why is the T-47.1 residential real property declaration in lieu of affidavit important?

- Who prepares the T-47.1 residential real property declaration in lieu of affidavit?

- What are the contents of the T-47.1 residential real property declaration in lieu of affidavit?

- What Date Goes on the T-47?

- How to Complete the T-47?

- How is the T-47.1 residential real property declaration in lieu of affidavit executed?

- What happens if the T-47.1 residential real property declaration in lieu of affidavit is not filed?

- What is the difference between a T-47.1 residential real property declaration in lieu of affidavit and a survey?

- Can the T-47.1 residential real property declaration in lieu of affidavit be amended?

- What is the cost of a T-47.1 residential real property declaration in lieu of affidavit?

- How long is the T-47.1 residential real property declaration in lieu of affidavit valid?

- Who retains the original T-47.1 residential real property declaration in lieu of affidavit?

- What are some common mistakes made while completing a T-47.1 residential real property declaration in lieu of affidavit?

- What are some frequently asked questions about T-47.1 residential real property declaration in lieu of affidavit in Texas?

What is a T-47.1 residential real property declaration in lieu of affidavit?

A T-47.1 residential real property declaration in lieu of affidavit, often referred to as the "Affidavit of Physical Condition", is a legal document used in Texas real estate transactions. It confirms that the seller has not made any changes or improvements to the property since the most recent survey was completed. By signing the form, the seller provides a sworn statement verifying the current condition of the property.

Why is the T-47.1 residential real property declaration in lieu of affidavit important?

The T-47.1 residential real property declaration in lieu of affidavit is an important document in Texas real estate transactions and plays a key role in the buying process. It helps protect the buyer from potential misrepresentations or undisclosed changes affecting the property’s boundaries. By confirming the property’s current boundary condition, the affidavit allows the buyer to move forward with greater confidence and make a well-informed purchasing decision.

Who prepares the T-47.1 residential real property declaration in lieu of affidavit?

In most cases, the title company or the seller’s real estate agent provides the T-47.1 residential real property declaration in lieu of affidavit to the seller either when the property is listed for sale or after a contract is received from a buyer. The seller must sign the affidavit in the presence of a notary public, who verifies the seller’s identity and confirms that the signature is authentic.

What are the contents of the T-47.1 residential real property declaration in lieu of affidavit?

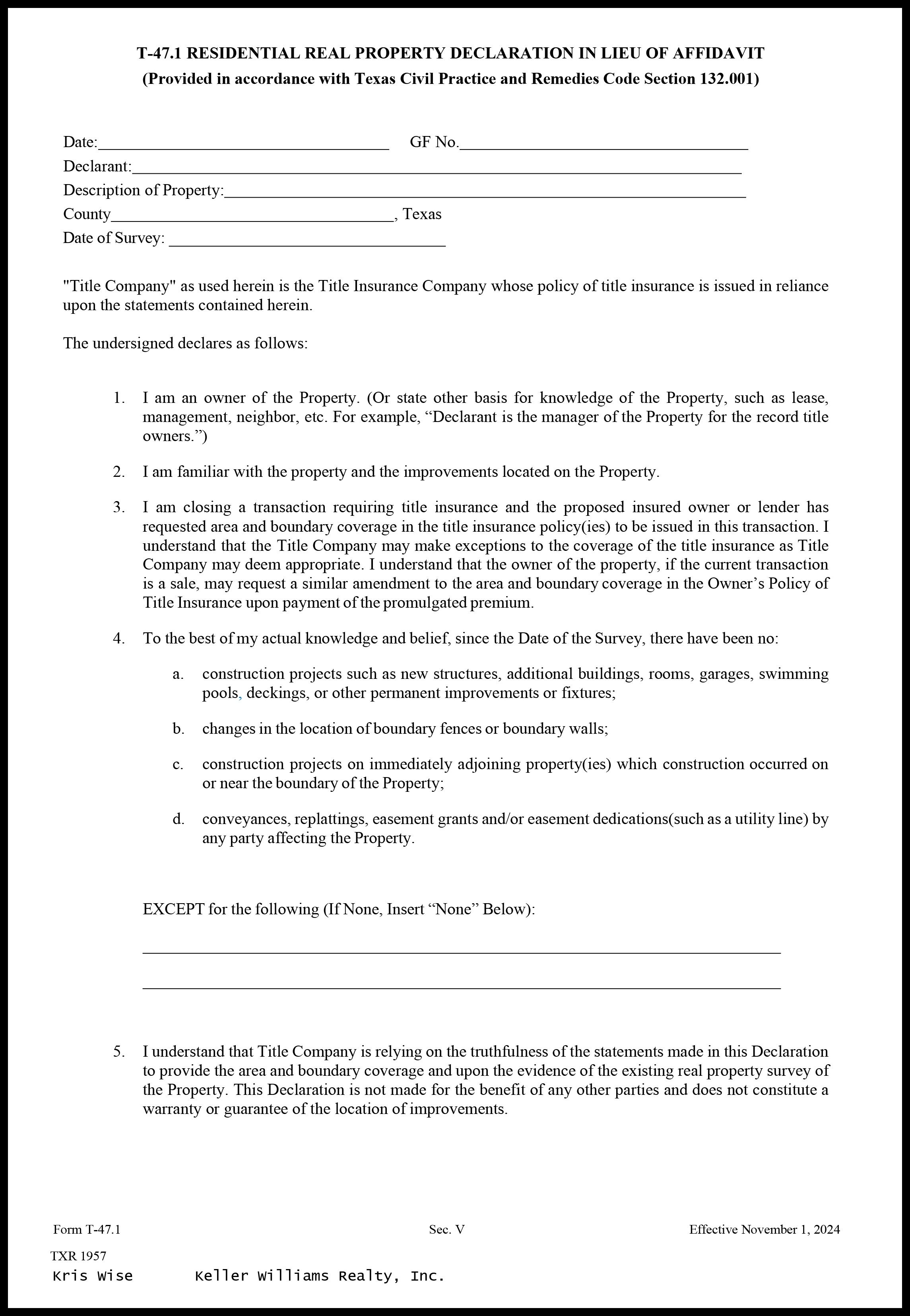

The T-47.1 residential real property declaration in lieu of affidavit provides key details about the property, including its legal description, address, and the date of the most recent survey. It also includes the seller’s sworn statement regarding the property’s current condition and whether any changes or improvements have been made since the survey was completed. The seller must disclose whether any of the following have occurred: construction of new structures or additions, such as buildings, rooms, garages, swimming pools, or other permanent improvements or fixtures; changes to the location of boundary fences or walls; construction on neighboring property that encroaches onto the property; any conveyances, replattings, easement grants, or easement dedications (such as utility lines) affecting the property

What Date Goes on the T-47?

The date listed on the T-47 should be the actual date the document is signed by the affiant, who is typically the seller. It is essential that this date is accurate and reflects when the affiant truly executed the form. Any discrepancies or errors on the T-47 can cause delays or complications in the real estate transaction.

How to Complete the T-47?

Completing the T-47 can be a detailed process, and it is essential to complete it accurately to prevent legal complications or delays in the real estate transaction. The following steps outline how to properly complete the T-47:

- Identify the affiant. The affiant is typically the seller of the property, but it can also be a representative of the seller, such as a real estate agent or attorney.

- Identify the property. The T-47 should include the legal description of the property, including the lot number, block number, and subdivision name.

- Provide details about any changes to the property. The affiant should provide details about any changes that have been made to the property since the last survey was completed. This may include additions, repairs, or alterations.

- Sign and date the T-47. The affiant should sign and date the T-47 to certify that the information provided is accurate and complete.

- Submit the T-47 to the appropriate parties. The completed T-47 should be submitted to the buyer, the title company, and any other relevant parties.

How is the T-47.1 residential real property declaration in lieu of affidavit executed?

The T-47.1 residential real property declaration in lieu of affidavit must be signed in the presence of a notary public. The seller executes the affidavit before the notary, who verifies the signer’s identity and certifies the signature. The notary then applies their official seal to confirm that the document was properly acknowledged.

What happens if the T-47.1 residential real property declaration in lieu of affidavit is not filed?

If the T-47.1 residential real property declaration in lieu of affidavit is not provided, the buyer may be unable to secure title insurance for the property. Title insurance protects the buyer against potential defects in the property’s title, and without a completed T-47, that coverage may not be available. In some cases, the buyer may choose to obtain a new survey instead, with the cost paid by either the seller or the buyer, depending on what is negotiated in the transaction.

What is the difference between a T-47.1 residential real property declaration in lieu of affidavit and a survey?

A survey is a drawing or map that identifies a property’s boundaries and shows its location in relation to surrounding properties. In contrast, the T-47.1 residential real property declaration in lieu of affidavit is a statement completed by the seller confirming the property’s current condition and disclosing whether any changes or alterations have been made since the most recent survey was prepared.

Can the T-47.1 residential real property declaration in lieu of affidavit be amended?

Yes, the T-47.1 residential real property declaration in lieu of affidavit may be amended if corrections are needed to address errors or omissions. Any revisions must be signed and acknowledged before a notary public, and all parties involved in the property transaction must consent to the changes.

What is the cost of a T-47.1 residential real property declaration in lieu of affidavit?

The cost of a T-47.1 residential real property declaration in lieu of affidavit can vary depending on the title company or attorney preparing the document, as well as any applicable notary fees. The Texas Department of Insurance promulgates the T-47.1 residential real property declaration in lieu of affidavit form, which is available on its website. In addition, a knowledgeable real estate agent representing the seller can often provide the T-47.1 residential real property declaration in lieu of affidavit to their client.

How long is the T-47.1 residential real property declaration in lieu of affidavit valid?

The T-47.1 residential real property declaration in lieu of affidavit remains effective through the closing of the property sale. After closing, it becomes part of the property’s permanent transaction record.

Who retains the original T-47.1 residential real property declaration in lieu of affidavit?

The original T-47.1 residential real property declaration in lieu of affidavit is typically retained by the title company and the buyer. In some cases, a copy may also be filed with the county clerk’s office in the county where the property is located. In addition, real estate brokers in Texas are required to keep transaction records for up to four years for any transactions in which they were involved.

What are some common mistakes made while completing a T-47.1 residential real property declaration in lieu of affidavit?

Common mistakes when completing a T-47.1 residential real property declaration in lieu of affidavit include omitting the property’s legal description, failing to include the date of the survey, or neglecting to disclose changes or alterations made to the property. It is essential that all information in the affidavit is accurate and complete to help prevent potential legal issues or delays in the future.

What are some frequently asked questions about T-47.1 residential real property declaration in lieu of affidavit in Texas?

FAQs

-

Is the T-47.1 residential real property declaration in lieu of affidavit required for all property sales in Texas?

Yes, the T-47.1 residential real property declaration in lieu of affidavit is required for all property sales in Texas. -

Can the T-47.1 residential real property declaration in lieu of affidavit be executed after the closing of the sale?

No, the T-47.1 residential real property declaration in lieu of affidavit must be executed before the closing of the sale. -

Who is responsible for paying for the T-47.1 residential real property declaration in lieu of affidavit?

If there is a cost involved, the cost of the T-47.1 residential real property declaration in lieu of affidavit is typically paid for by the seller but the parties must rely on the exact language of the contract to determine who is responsible for the cost. -

What happens if the T-47.1 residential real property declaration in lieu of affidavit contains inaccurate information?

If the T-47.1 residential real property declaration in lieu of affidavit contains inaccurate information, it can lead to potential legal issues in the future. -

Can the buyer waive the requirement for a T-47.1 residential real property declaration in lieu of affidavit?

No, the requirement for a T-47.1 residential real property declaration in lieu of affidavit cannot be waived. It is a necessary document for the protection of the buyer during the property buying process.

Conclusion

In summary, the T-47.1 residential real property declaration in lieu of affidavit is an important legal document in Texas real estate transactions. It verifies the property’s condition and helps protect the buyer from potential misrepresentations by the seller. To avoid future legal complications, it is essential that the affidavit is completed thoroughly and accurately.

Below is a sample T-47.1 residential real property declaration in lieu of affidavit along with step-by-step instructions to help you complete it properly. If you have any questions or need additional guidance, our experienced real estate professionals are here to help you navigate every stage of the transaction. We look forward to assisting you and encourage you to reach out anytime with questions or concerns.